- 2021.12.24

- investjapan

- investorjapan

- propertyJapan

- realestatejapan

Golf courses in Japan as investment target

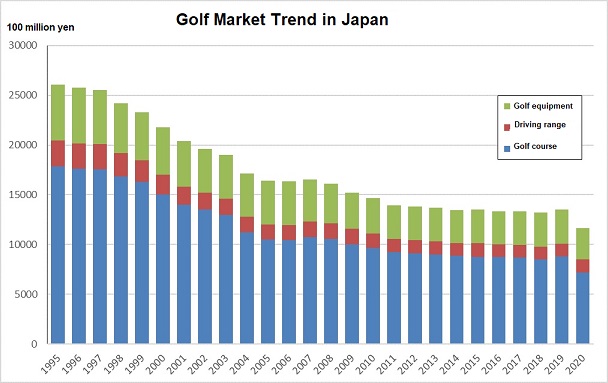

With the decline in the golf population, the operation of golf courses has been sluggish. According to the “White Paper on Leisure”, the domestic golf course market has been shrinking for 20 years. Real estate companies are looking at golf courses that are on the verge of closure. As it can be diverted to a logistics site where demand increases due to the expansion of EC (online shopping), it can generate significant profits.

Large logistics facilities have a site area of more than 100,000 square meters, but there are not many opportunities to obtain vast land with good access from consumption areas. Large-scale factories and warehouse sites have few offerings in the market, and it takes time to create fields and forests and create land. In that respect, golf courses with a large site area and good access from railways and expressways are attractive as logistics sites.

Golf courses that were a non-working asset may turn into a logistics site, there is a view that “a company that owns a golf course can be subject to M&A”.

(Toyo Keizai)

Masaki Tanzawa

RE/MAX Migration Realty / AER NEXT LLC.

7F, KeioShinjuku321 Bldg., 3-2-1, Shinjuku, Shinjuku -Ku, Tokyo, JAPAN 160-0022

TEL +81-3-5341-4611 FAX +81-3-5341-4623

Property Agent License: Tokyo (1)105965

Email: tanzawa@ablife.jp WhatsApp: +81 80 3313 5020

https://www.facebook.com/AER-NEXT-LLC-113040817819191

https://www.investorvisa.jp/investjapan/

https://www.facebook.com/InvestVisaJapan

https://www.facebook.com/businessandinvestjapan

https://www.facebook.com/nisekojapaninvest

https://www.instagram.com/m.tanzawa/