- 2021.04.14

- Japan business manager visa

- Japan investment

- Japan property

Number of contracts in second-hand condos recorded high at March, 2021 Tokyo

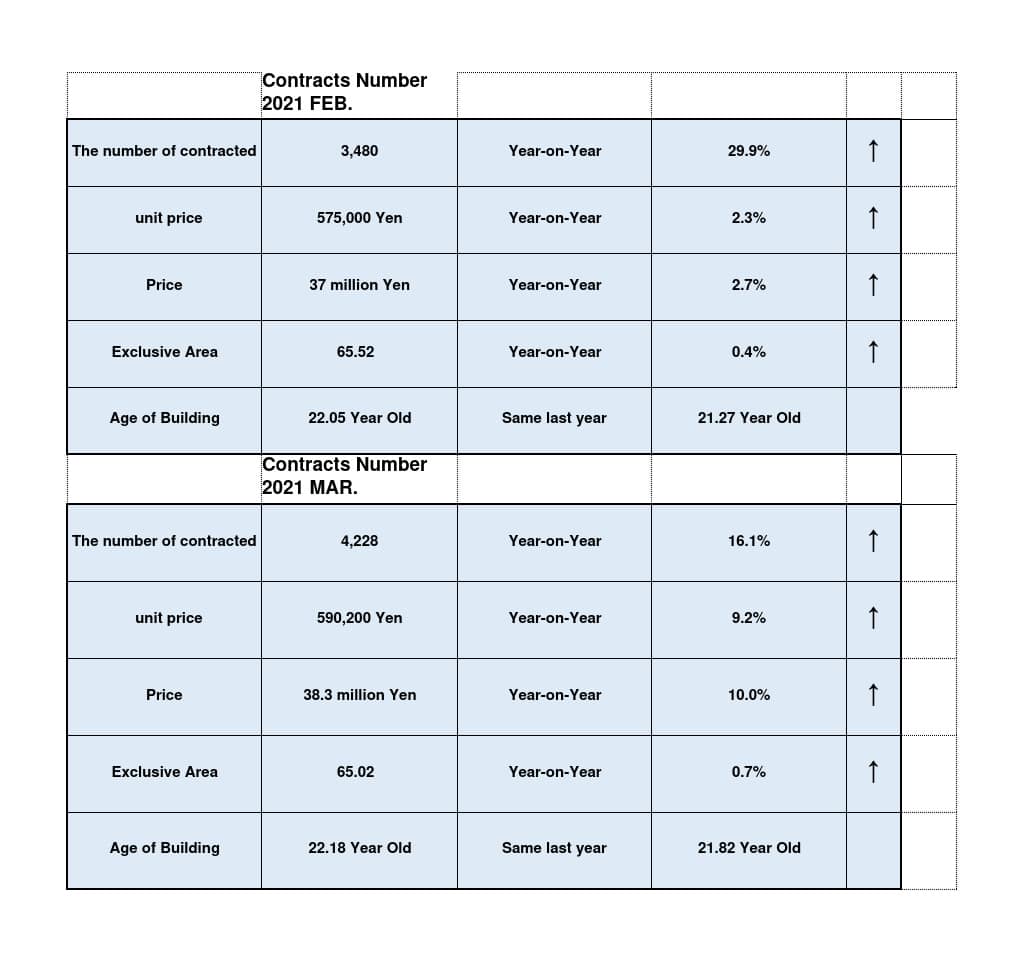

According to the latest news reported by the Real Estate Information Network for East Japan, the contracted number of second-hand condos in Tokyo reached the highest figure since the start-up of this Network in 1990.

Masaki Tanzawa, Licensed Real Estate Broker & Management Manager

Masaki Tanzawa, Licensed Real Estate Broker & Management Manager

The number of contracts is 4,228.

Year-on-Year comparison is 16.1% increase. This increase rate is a record high since the establishment of

the Real Estate Information Network System.

The unit price/㎡ is 590,200 Yen. Year-on-Year is 9.2% increase. This has also increased from last month.

Under COVID-19 crisis, this figure is surprising although expected. I would say this trend is likely to continue.

Why so?

I show you 2 points in my view.

1. Demand for these condos is still high, in particular better location which means property near the station and convenience for shopping or other life-related facilities like hospitals and schools, as many people tend to view property value in surroundings even though the building is a little aged. Most aged condos were constructed at a time when a good location was still vacant, so they were built preferably.

2.Supply of new-build condos and second-hand is not enough now.

In fact New registration number of condos in the market is 13,648 and year-on-year comparison is 19.3% decrease.

I say it is a good opportunity for investors to invest in such properties.

And this encourages you to go to establish new business and advance to acquiring a Japan Business Manager Visa if you want.

Let us go back to my talk about the relation between Japan Business Manager Visa and Property renting business.

In order to obtain and renew the business manager visa by property investment, anyway it is necessary and important to make a profit and keep it up.

Specifically in the rental business you need to cover all business expenses with the rent income. That is, the Balance forecast should be positive for accounting.

For making the balance forecast favorable, I would like you to know the key point when you find property binding to lease business.

That is , a second-hand condo building is recommended to be worked for rental business. That is why I believe it will be plain and probable to run the renting business in an apartment house. Having an apartment house will be capable of diversification of risk and persistence. It just depends whether you can find a good property decreasing a risk of vacancy.

But please note the point of view below when you look for second-hand ones so as not to fail.

You may see a good yield advertised in the selling property such as 10% and more. For example, if you can look at an advertisement as 8-9% yield expected, in this case it will be enough to consider it to be actually 5%-6% at most.

For that, it is inevitable that annual expenses must be figured and counted in the calculation of annual earnings.

Let’s assume the calculation as model cases for you to feel real.

1st case in Tokyo Central

Step 1

If you purchase a building of condominium of 200 million yen (1.8 million us dollars) including the site area 70 ㎡ + building

Total amount of purchase price is to be about 220 million yen (2.0 million us dollars), as the initial cost of the buying procedure is estimated to be about 10% of the purchase price.

Step 2

To set up a company to hold the condominium and you will be an executive officer of this company

And to figure out the annual revenue of the company

Assumed annual rent to be about 11.7 million yen (about 110,000 us dollars)

The breakdown is:

It is assumed that the condo has 9-room with 18 ㎡ one studio room, and average rent price 6,000 yen/㎡, so the monthly rent per room will be 108,000 yen.

108,000 yen × 9 rooms × 12 months = 11,664,000 yen annual revenue ≒ 11.7 million yen (about 110,000 us dollars)

Step 3

To calculate net profit:

The amount of annual expenses is estimated to be about 4 million yen (37,000 us dollar)

Net annual yield is 11.7 million yen – 4.0 million yen = 7.7 million yen ( about 70,000 us dollars)

Net yield rate = 7.7 million yen ÷ 200 million yen × 100 = 3.8%

You will be paid a salary accordingly as an executive officer from the company revenue. (It is said in general that 2.4 million yen and more will be necessary at least for an executive salary)

If you wish to find more return from property investment in the short term, it will be possible to pick up the following model case.

2nd case in Suburbs of Tokyo

Step 1

If you purchase a building of apartment of 150 million yen (1.4 million us dollars)

including the site area 200 ㎡ + building

Step 2

Assumed annual rent to be about 15.8 million yen (about 144,000 us dollars)

It is assumed that the apartment has 25-room of 16 ㎡ one studio room, and average rent 3,300 yen/㎡ × 16㎡ = 52,800 yen monthly rent per room.

52,800 yen × 25 rooms × 12 months = 15,840,000 yen annual revenue ≒ 15.8 million yen (about 144,000 us dollars)

Step 3

The amount of annual expenses is estimated to be about 1.6 million yen (14,600 us dollars)

Net annual yield = 15.8 million yen – 1.6 million yen = 14.2 million yen (about 130,000 us dollars)

Net yield rate = 14.2 million yen ÷ 150 million yen × 100 = 9.46%

The profit amount and rate is agreeable in case 2. However, a risk of vacancy may be a little higher than case 1, and costs for frequent repair should be considered and reserved in case 2.

I presume either these cases are a sufficiently possible figure if you can pick up the right scheme.

Anyway the company needs to keep running business and expanding year by year while renewing a business manager visa.

So that for business continuity, it would rather be recommended to invest in one condominium/apartment building than a single luxury house or one room of a luxury apartment.

Do you need help to invest and apply for a visa?

I have a good partnership with legal offices to assist visa applicants with new application and renewal.

However please note that this does not guarantee the acquisition of a business manager visa.

Please inquire me when you are looking for a property in Tokyo.

Please let me know when you think to apply for the visa, I will help you jointly with a reliable law office.

Please feel free to contact me if you have further inquiries.

AER NEXT LLC.

Address: Keio Shinjuku Bldg. 7F, 3-2-1, Shinjuku, Shinjuku-ku, Tokyo 〒160-0022

Contact Person: Masaki Tanzawa

email: tanzawa@ablife.jp

Website:https://www.investorvisa.jp/investjapan/

License Number of Real Estate Broker: Tokyo 105965