- 2021.03.29

- Japan business manager visa

- Japan property

- Japan Property Investment

- Property Market Price

Capital and Income gain in Japan Property Investment

Aiming at income-gain by property investment will be almost advantageous than capital-gain in Japan.

Hello! I am Masaki Tanzawa and licensed property management professional.

Needless to say, you all know quite well that speculation and investment is different.

Property purchase in Japan is just fit with the investment angle.

In particular, targeting Tokyo is an appropriate approach as property investment.

Let’s view investment cases in Tokyo aiming at capital-gain and income-gain.

As I previously mentioned, anticipating sufficient capital-gain from investment in Tokyo is rather rare.

Official Land Price reportedly went down

In fact some of you might find the latest news that reported the official land price announced recently shows a decrease in Tokyo for the first time in 8 years.

Everyone simply could analyze it as caused by COVID-19 pandemic, and it is a natural flow worldwide.

Downturn in demand for the commercial sector mainly caused the land price decline.

How does this fall affect property investment in Japan?

The decrease in the official land price may lower the market price as well.

You may see the lowered market price leads to prospects of gain on sale in terms of capital-gain purpose.

My view is different from this.

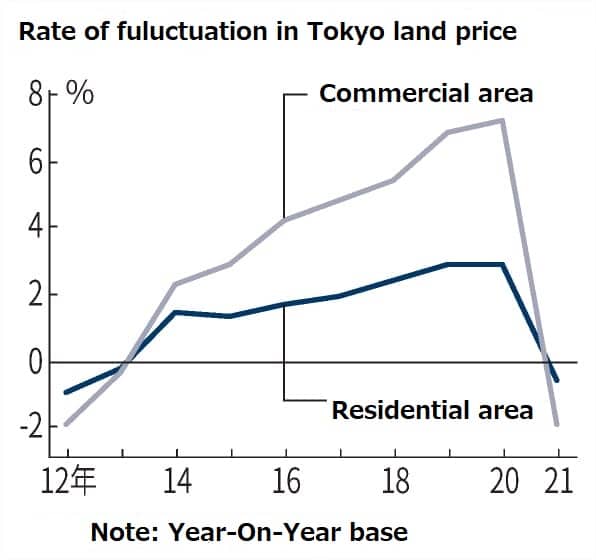

According to the line graph, especially the fall of price is seen remarkably in the commercial area, because increase of cessation of business or closed shop due to the pandemic led to decline.

However the degree of decline is not so much in the residential area.

Actually the rate of decline in the residential area was 0.6%, that in the commercial area was 1.9%.

So I do not presume the descent of a market price will happen remarkably in the housing market.

Which is better to pursue the capital-gain and the income-gain in Japan?

Indeed it may be possible to foresee a capital-gain utilizing the slight balance between the market price lowered and the future price restored in several excellent properties.

But it will be so hard to find such a promising property profitable enough, and it has to be a high-risk challenge if it is in the short term.

You need additionally to note the capital gain tax comes to be higher in case of selling within 5 years after purchase.

Anyway the market price of property in Tokyo is slowly rising, but it is totally unforeseeable in the property market to show violent fluctuations any longer.

On the other hand if you look at this status by changing view, this is the chance of expectation of mid or long-term income-gain. And you can obtain a stable core-asset from a long-term perspective.

Assuming that the retail price is decreased from the standardized price, then you could get a little better deal than usual. And consequently you can expect slightly higher return than before, as the rent may not go down as well.

What type of property is better to buy for aiming at steady income-gain?

For the purpose of income-gain in property investment, you would in general rent out your property to earn monthly rent.

In this case it is recommended to own residence such as a condominium, a house and a building of apartment.

Buying and owning property of residence would be also rather easy-to-handle if you will consider to proceed applying for a business manager visa in Japan by business operation.

And Tokyo is a place which is suitable for pursuing steady rental business.

What about logistic sectors to invest?

I would say that it is not a bad idea to buy commercial property such as offices, industrial land and logistic space. Indeed the investment in these facilities is trend particularly in the logistic area, since the world-wide pandemic induced a demand for distribution industry due to online shopping used more than ever.

In my view, the logistic sector is not so steady as its popularity might be temporary, and it is riskier than the residential sector as investment amount becomes large.

But I will take up the logistic investment in Japan as a seminar theme later.

Please refer to my other blogs about return of investment for detailed information on the rental management, and why Tokyo is appropriate.

AER NEXT LLC.

7F, KeioShinjuku321 Bldg., 3-2-1, Shinjuku, Shinjuku -ku, Tokyo, JAPAN 160-0022

TEL +81-3-5341-4611

FAX +81-3-5341-4623

Contact person: Masaki Tanzawa

Email: tanzawa@ablife.jp

URL: https://www.investorvisa.jp/investorvisa/japan/