- 2021.03.04

- Business Manager Visa

- Japan Property Investment

- Second-Hand Condominiums

Japan Property Investment with Second-hand condominiums

For all those who are interested in Japanese investor visa and investment in property.

Hello! Again!

My name is Masaki Tanzawa, and I am a licensed property management manager in Japan.

And I have good partners to help for an application of Japan Business Manager Visa.

So I would like to provide you with useful information about Japan Property Investment and Business Manager Visa featuring the latest news and topics.

This time let’s take a closer look about the second-hand condos market.

Why now Second-Hand Condos have become popular as an investment target?

When I would say the advantages of second-hand condos in the investment are points following.

1. Initial cost is low

2. The price is lower than the newly built condos

3. The management status can be seen

4. The location is good

And it is highly recommended to focus on Tokyo from the perspective of maintaining asset value.

For proving this, let’s see the background information first.

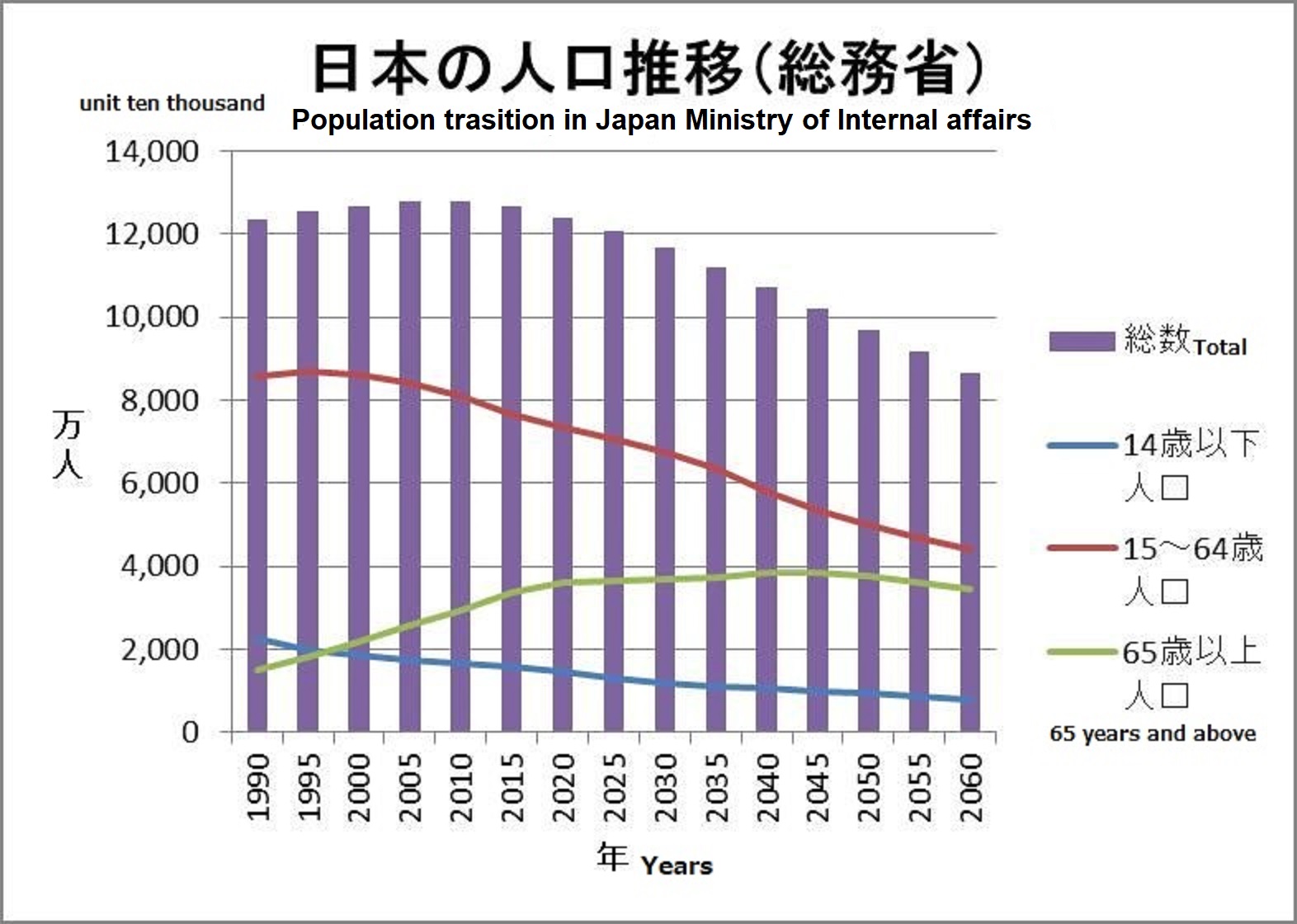

Since 2008, Japan’s population decline has already progressed.

From: Ministry of Internal Affairs and Communications Statistics

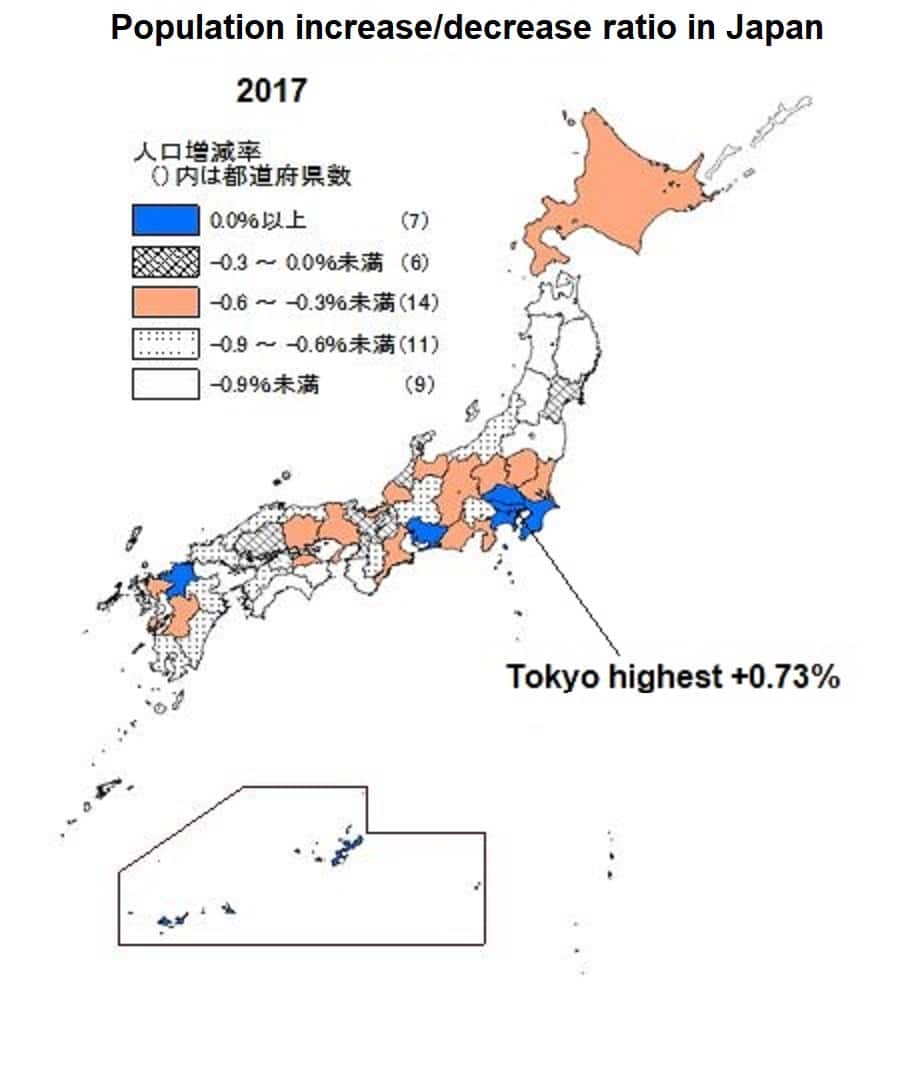

However the population of Tokyo is increasing and concentration is progressing. Tokyo is definitely the place where people and things gather structurally.

The population is nearly 14 million now.

From: Ministry of Internal Affairs and Communications Statistics

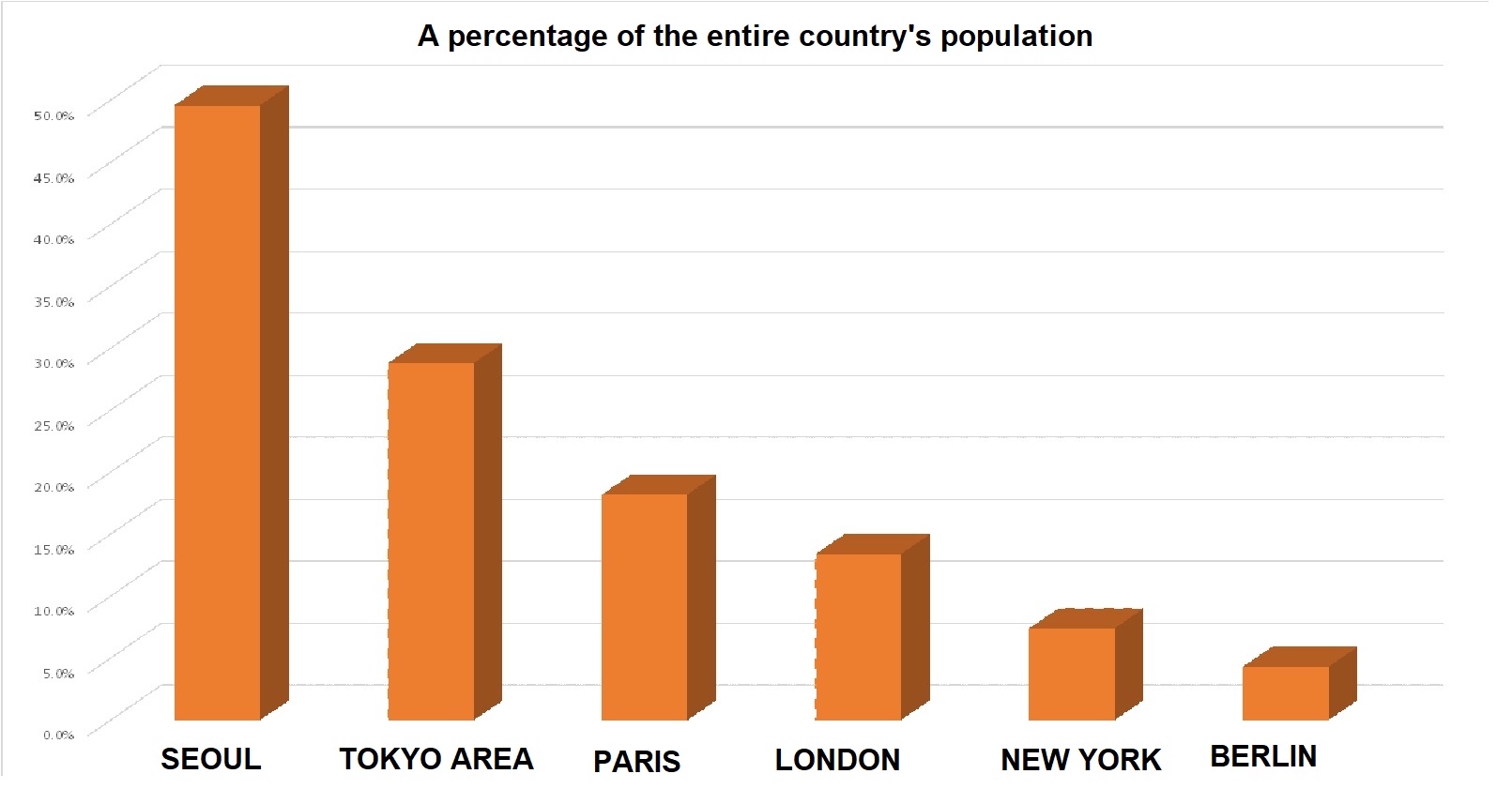

A percentage of the entire country’s population is the second largest in the world.

And also there are about 3,800 listed companies in Japan, more than half of which are headquartered in Tokyo.

This naturally causes population concentration in the past and in the future.

Public opinion keeps saying to revise the centralization in Tokyo.

But Tokyo grows still and shows no signs of fading its concentration.

From: Ministry of Land, Infrastructure, Transport and Tourism 2017

Standing in the background, I will move on to the analysis of the market status of second-hand condos.

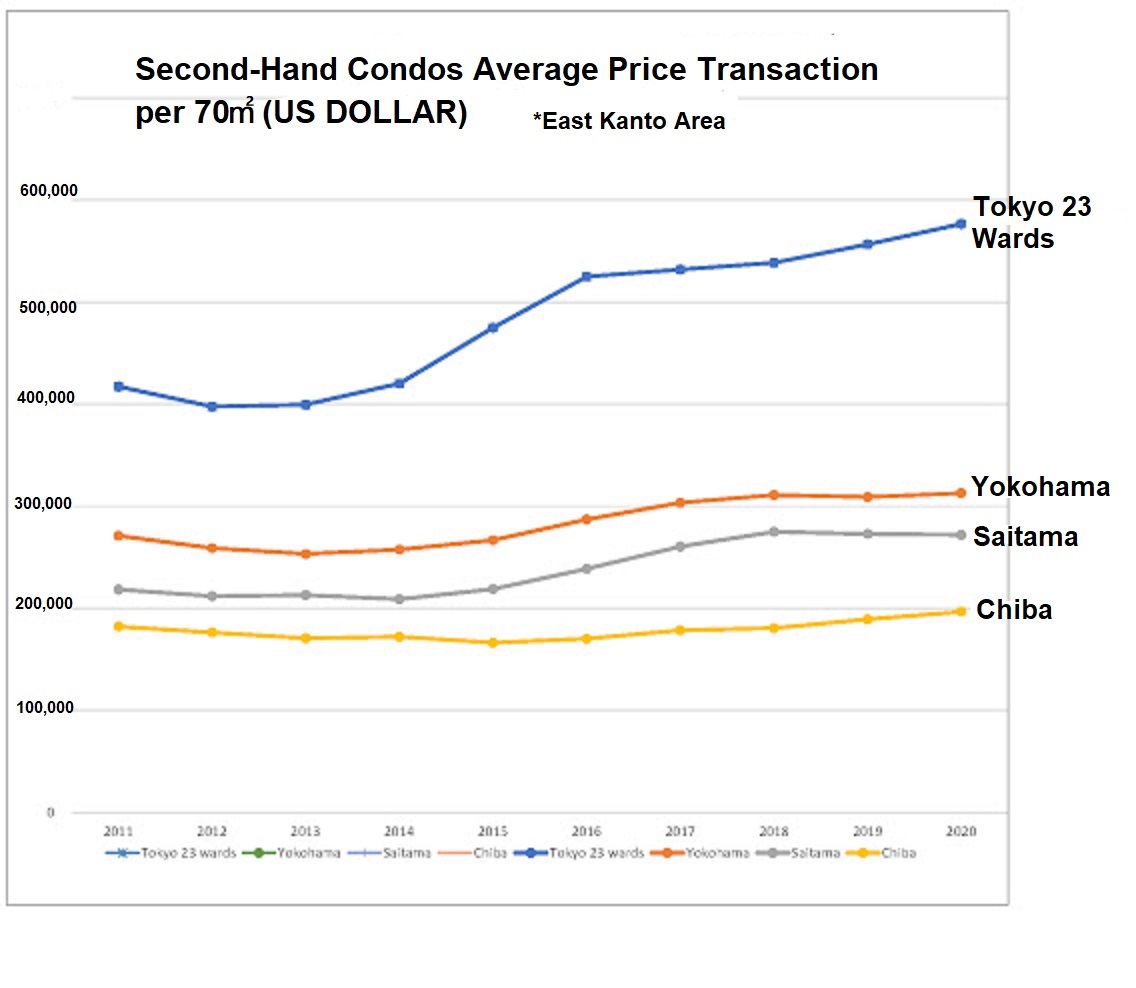

Created from data of real estate economic institute

The above line graph clearly shows Tokyo is up-trend in the average price of second-hand condominiums in transaction.

This trend is only seen in Tokyo (Tokyo 23 wards).

Average price of second-hand in the Tokyo central area increased by 0.7% year-on-year in 2020, maintaining an upward trend.

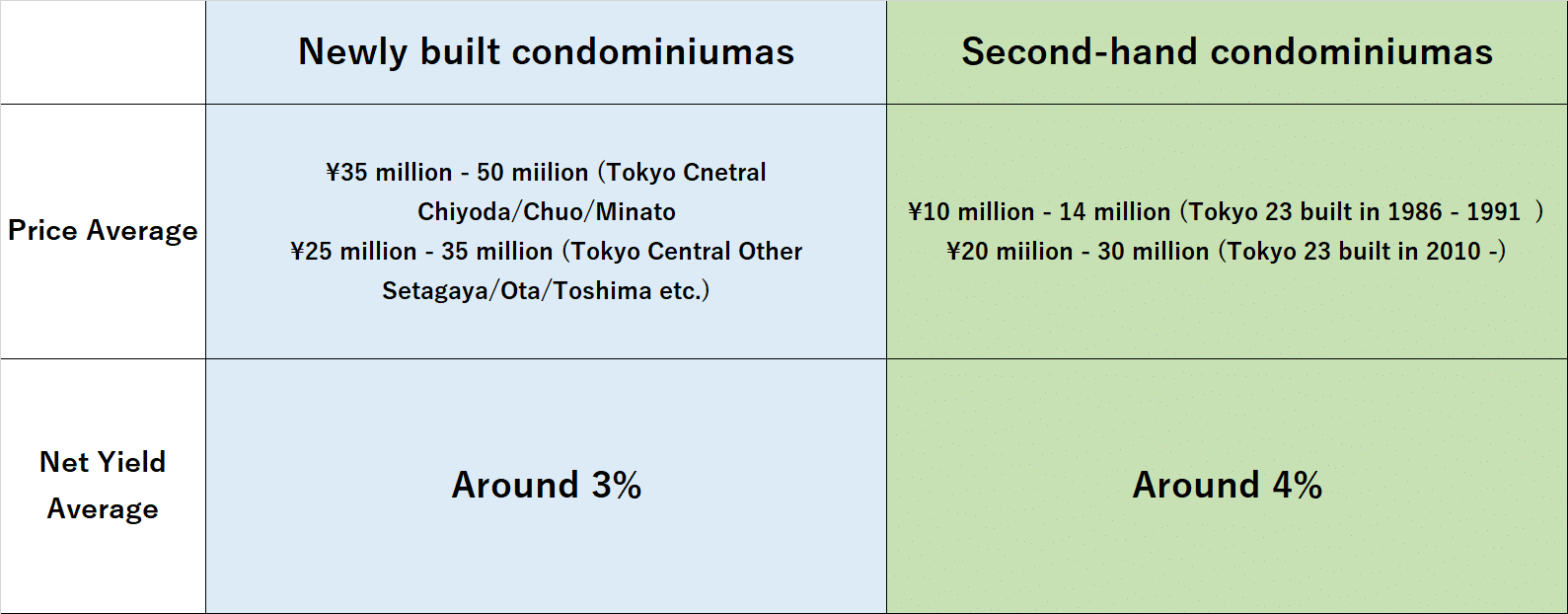

Looking at the pricing factors, the price of the newly built condo is determined by the sales company, and the price tends to be high by all means.

Because promotional and advertising expenses, and labor costs are added to the price.

On the other hand, the price of a second-hand condo is decided in relation to supply and demand. Therefore, it is possible to purchase at a reasonable price compared to new construction.

The price of second-hand is about 70 to 80% of new condos in the same area.

However, the rent is not much different, so relatively high yields can be realized for second-hand condos compared to newly built ones.

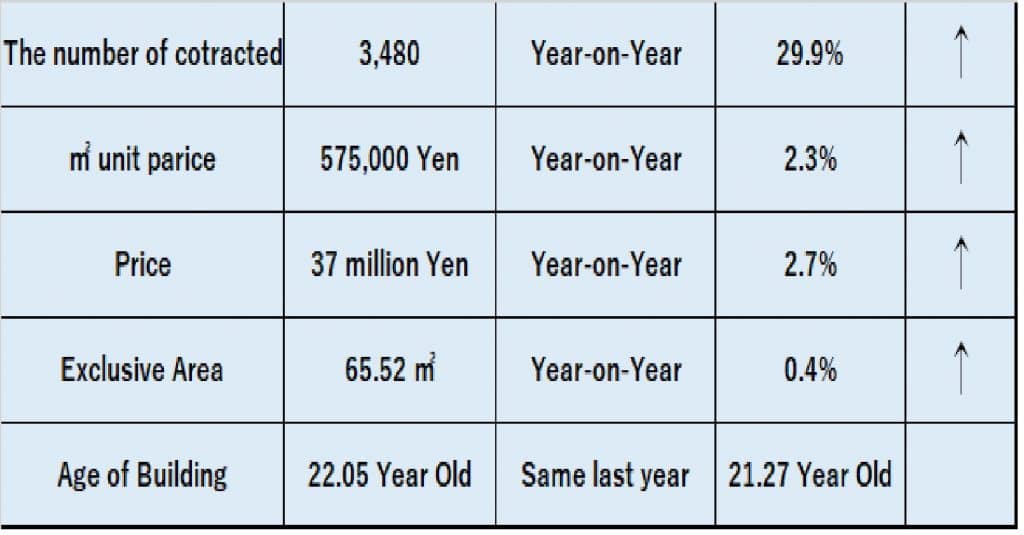

Latest report by the real estate information network system in east Japan supports the trend.

Data from the real estate information network system

Secondly, the demand for second-hand ones is increasing as the supply of new construction decreases.

Therefore, the price of second-hand stopped lowering.

According to the report below of the real estate information network system of east Japan,

The number of second-hand condos contracted in the Tokyo Capital Area in January 2021 shows an obvious increase.

From The Real Estate Information Network System East Japan

Tokyo is the only place suitable for property investment now and in the future.

What is the appropriate age of second-hand building?

Lifetime of Reinforced concrete construction is legally ruled as 47 years old in Japan.

It is however only for tax purposes, I would see its service life will be more than 60 years onward if built in the new earthquake resistance standards.

Buildings in Japan are well constructed and robust, as Japan is an earthquake country.

So I advise that 20 -30 years old condos are still well worth the investment, if they satisfy certain conditions.

You need to check the building from various angles, such as

1.What the value of the building will be in the future,

2.Whether it meets the new earthquake resistance standards,

3.Whether it has been properly maintained, etc.

In conclusion, I would like to emphasize to see the balance between the number of years built and the price.

Please come to me if you are interested in Japanese Property Investment with a Business Manager Visa.

AER WORLD CO., LTD.

Address: Keio Shinjuku Bldg. 7F, 3-2-1, Shinjuku, Shinjuku-ku, Tokyo 〒160-0022

Contact Person: Masaki Tanzawa

email: tanzawa@ablife.jp

Website: https://www.investorvisa.jp/investorvisa/japan/